Mind the Gap: Bridging Board Oversight and Operational Realities

Background

Risk management failures in mid-sized and emerging companies have made headlines from Silicon Valley to Mumbai, often tracing back to a troubling disconnect between boardroom understanding and on-the-ground realities. This “board-versus-operational reality” gap in risk oversight has tangible consequences; from financial losses and regulatory penalties to reputational damage. A recent consulting survey indicated nearly 55% of board members say their company’s risk management struggles to keep pace with business strategy changes.

In an era of rising uncertainties, board members and independent directors are expected to serve as crucial sentinels, yet their effectiveness is often hampered by cultural and informational barriers. As a part of this series, we explore in this article as to why mid-sized enterprises are prone to governance gap, the real-world fallout when it goes unaddressed, and how boards can close the chasm between the view from the boardroom and the operational reality on the ground.

Understanding the Oversight Gap

Every corporate board has a fiduciary duty to oversee risk, but there’s often a disconnect between what boards believe about risk management and what’s actually happening within the organization. In many mid-sized firms, boards receive periodic risk reports and updates that paint a reassuring picture. Risks identified, controls implemented, compliance boxes checked. Yet the day-to-day reality in business units or project teams can be very different. Metrics and reports presented to the board may be incomplete or overly optimistic, leading to a false sense of security at the governance level.

Boards often overestimate risk management effectiveness due to incomplete information and structural weaknesses, leaving mid-sized firms vulnerable to crises. This gap is not due to negligence or indifference from boards, but rather structural and cultural challenges.

Root Causes of the Gap

- Information Asymmetry: Senior executives may filter what they escalate to the board, and mid-level managers might downplay or fail to report issues upward, especially in a culture that ‘shoots the messenger’.

- Limited Risk Expertise: Limited expertise in specific risk areas often exacerbates the problem. If directors aren’t well-versed in emerging risks (be it cybersecurity, regulatory compliance, or operational safety), they may not know the right questions to ask or may accept vague assurances. In fact, one analysis observed that a lack of operational risk expertise can make board members reluctant to stray from their domain.

- Siloed Reporting: Operational risks are often tracked inconsistently, failing to reach the board in a meaningful way. Without the right data and Key Performance Indicators (KPIs), they might not realize the true magnitude of certain risks.

- Differing Perspectives & Priorities: It helps to recognize that boards and operational teams often view risk through different lenses requiring better communication to align high-level oversight with ground-level realities.

Why Mid-Sized Companies Are Especially Vulnerable

- Weak Risk Framework: Large multinational corporations often have extensive risk management frameworks, dedicated risk officers, and layers of oversight. In contrast, small and mid-sized enterprises (SMEs) frequently operate with leaner structures which can widen the board-operational gap. Research shows that many mid-sized companies do not have fully defined Enterprise Risk Management (ERM) programs due to cost constraints, limited resources, and fewer dedicated risk professionals.

- Lean Structures: Often, employees wear multiple hats; for example, the finance head might also oversee compliance, or operations managers double as safety officers. This can lead to gaps in expertise and bandwidth when it comes to systematically identifying and mitigating risks. The board might assume that “someone in management” is handling risk, but in reality, risk responsibilities can fall through the cracks in a mid-size organization’s structure.

- Rapid Growth: Mid-sized firms are frequently in high-growth mode. They are expanding into new markets, launching products, or undergoing digital transformation, all of which introduce new risks. However, governance processes in these companies often lag behind their growth. A post-mortem by regulators on Silicon Valley bank observed that the bank’s growth far outpaced the abilities of its board and management to install a suitable risk control infrastructure.

- Cultural Pressures: A ‘Business Today’ magazine analysis of recent startup scandals noted a “convenient lack of oversight from boards, as start-ups get caught up in the rat race of growth over profits”. Mid-sized enterprises, especially those led by founders or family owners, can have tight-knit cultures with strong top-down influence. If the leadership’s emphasis is on aggressive growth or hitting targets “at all costs,” employees may feel pressure to prioritize results over risk compliance.

- Weak Internal Controls: Mid-sized firms often lack the robust internal controls and audit functions that larger firms use to catch issues early. Risk assurance processes in a smaller company might be outsourced or minimal, and risk reporting may not be integrated company-wide. This means the board’s usual safety net, internal audit and compliance reports, may not be effective.

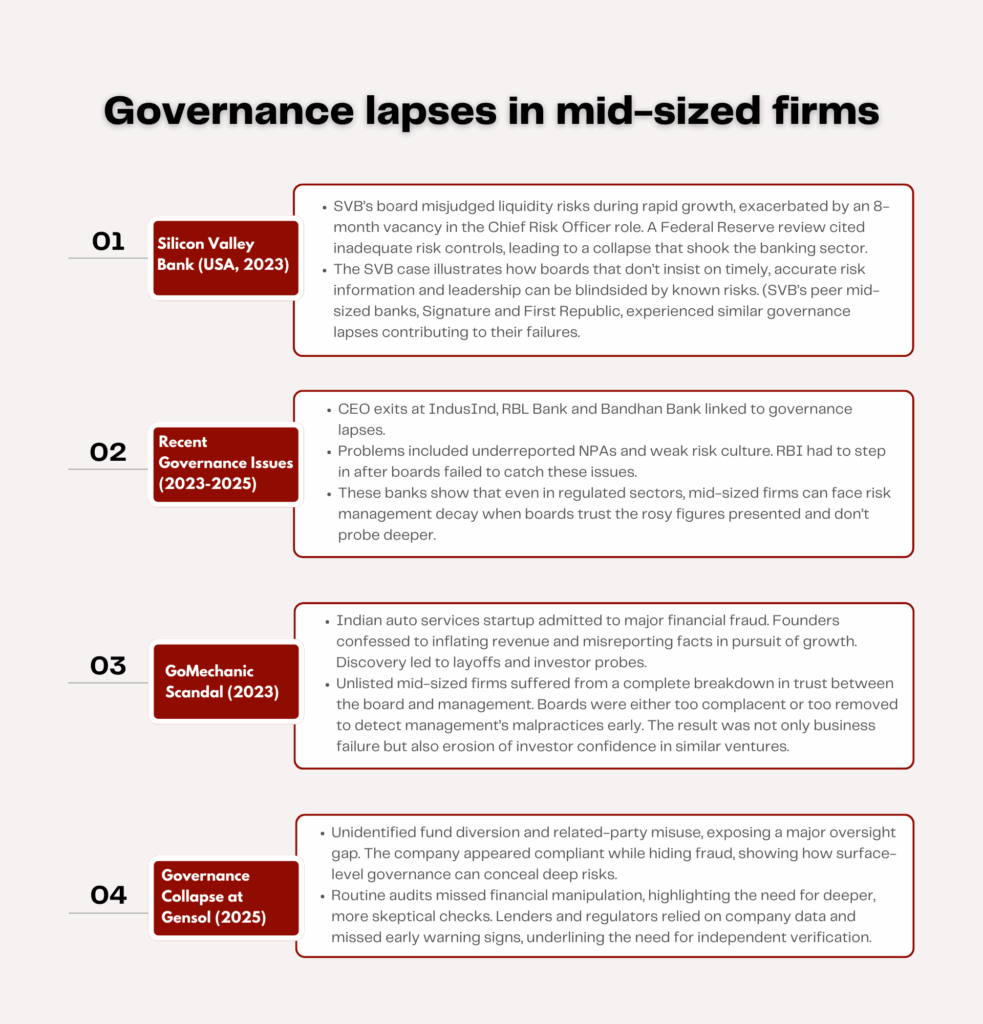

Understanding Recent Risk Management Failures – Real-World Consequences:

Governance lapses in mid-sized firms lead to serious failures, underscoring the need for boards to bridge the oversight gap. Recent cases illustrate how the board-operational disconnect fuels crises:

These examples across different sectors highlight the critical gap between boards oversight and operational realities, where incomplete knowledge of day-to-day operations led to risk management failures. Despite having boards and risk policies on paper, governance breakdowns allowed small issues to escalate into major crises. For mid-sized and emerging companies, closing the board-operations gap in risk oversight is not just a best practice but a strategic necessity for survival and success.

Closing the Gap: Practical Steps for Boards to Enhance Risk Oversight

Bridging the divide between boardroom perception and operational reality in risk management requires concerted action. Boards of mid-sized and emerging companies can take practical, actionable steps to enhance the sanctity of their risk oversight role. These steps span tools and technology, structural and process improvements, and cultural shifts. Below are key recommendations for boards and their companies:

- Unfiltered Communication: Boards must insist on clear and candid risk reporting. Boards should demand that risk reports be forward-looking, impact-focused, and unfiltered. Instead of high-level summaries that gloss over issues, reports should explicitly connect risks to business outcomes. This can be done through reviewing “risk dashboards” that include key risk indicators, incident logs, and mitigation status updates for major / emerging risks.

- Strengthen risk governance structure: Many mid-sized companies suffer because no single leader is accountable for enterprise-wide risk – plugging this gap is vital. Establish regular sessions where the risk officer and internal audit head can speak to directors without senior management in the room, fostering open communication.

- Translate Technical Risks & Elevate risk discussions: Operational details (e.g., “unpatched firewalls”) should be framed in business terms (e.g., “potential $2M loss from a breach”).

Make risk a standing priority at every board meeting. Just as financial performance and strategy are regularly discussed, insist that significant operational and strategic risks get airtime in proportion to their importance. Boards could also consider scenario planning and deep-dives: pick a few “what if” scenarios.

- Leverage Technology and Data for Risk Monitoring: In today’s digital age, even mid-sized companies can afford tools to enhance risk oversight. Boards should encourage management to utilize risk management software, dashboards, and data analytics to gain real-time visibility into risks. According to a 2025 survey, 76% of mid-market businesses already use technology in some aspect of risk management, but only 11% have fully integrated. There is immense room to grow here.

- Fostering risk aware culture through appropriate tone at the top: Perhaps the most critical yet intangible fix is cultural. The board and executive leadership must set the tone that risk management is everyone’s responsibility and is valued. Leadership should visibly recognize and reward teams that identify and manage risks well, turning risk management successes into learning moments company-wide. Conversely, there should be accountability when risk processes are ignored or warnings silenced. The board could ask for a “Risk Culture” assessment. If results show problems say, the board must push management to address this through appropriate training.

As experts advise, boards should exercise an “inquisitive mindset; digging deeper, challenging assumptions, and encouraging open communication. All before adverse events materialize.”

In essence, bridging the gap requires aligning these perspectives. When governance and implementation are in sync, Boards can anticipate issues and support management in addressing them proactively, rather than cleaning up surprises after the fact.

The Strategic Role of Independent Directors in Risk Oversight

Independent directors are critical for objective oversight, challenging assumptions and fostering a risk-aware culture. Independent directors bridge the gap by:

- Asking Tough Questions: Free from management ties, they probe operational realities (e.g., “Are cybersecurity resources adequate?”).

- Bringing Expertise: Directors with cyber or compliance backgrounds enhance oversight, reducing financial irregularities (per governance surveys).

- Setting Tone: By engaging risk managers directly and rewarding candor, they encourage issue escalation.

- Leadership in Crisis: As seen in BharatPe (2022), independent director can direct investigation of misconduct, thus protecting stakeholder interests.

In summary, Independent Directors also play a strategic role as risk sentinels and governance champions. They must use their position to ensure the board isn’t operating with blind spots. As one LinkedIn corporate governance commentary put it, independent directors act as “ethical custodians, guardians of shareholder interests, and champions of accountability,” reinforcing structures that mitigate risk.

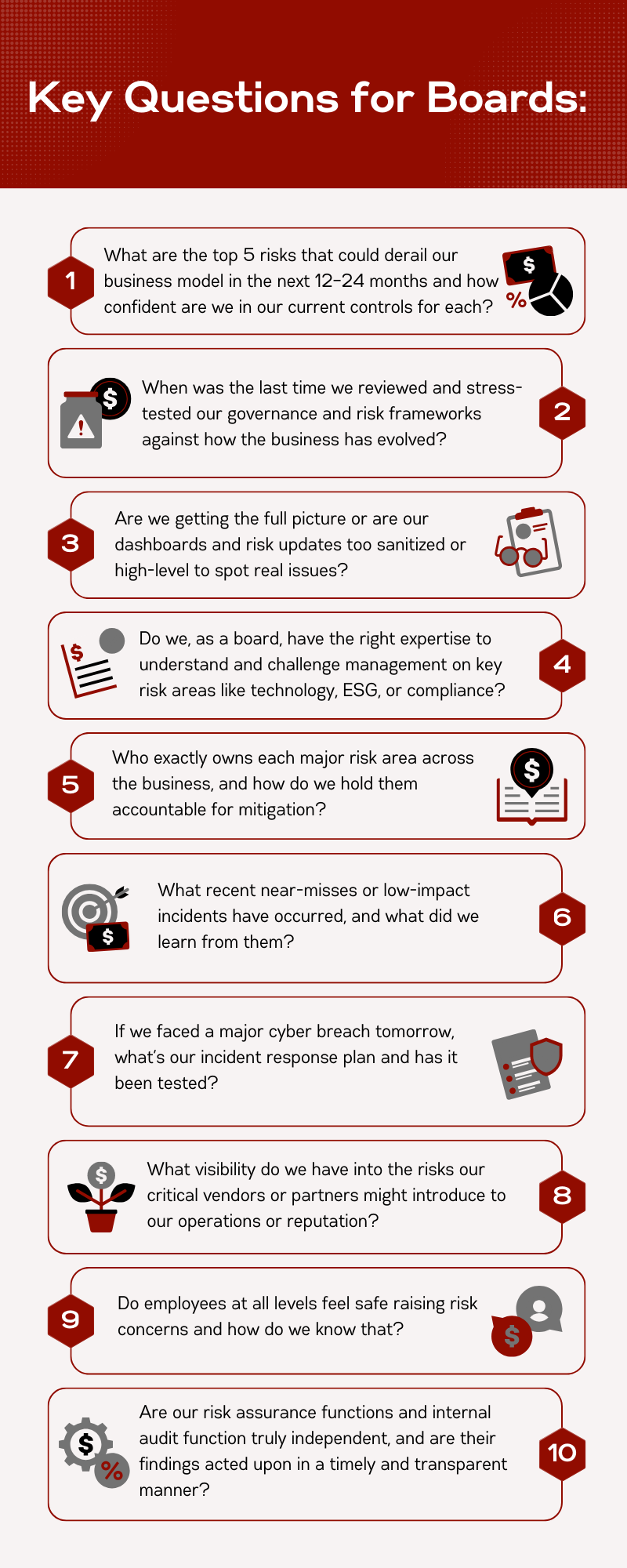

Conclusion: Strengthening the Board’s Risk Guardianship

We close this article with 10 sharp questions that we believe the board members & independent directors must ask in order to obtain comfort in the risk / governance framework within mid-sized enterprises. Obtaining comfort on these areas will naturally cascade into the direction and investments that need to be made towards better risk management.

As businesses globally navigate an increasingly volatile world; from cyber threats and supply chain disruptions to regulatory shifts and beyond, closing the board-operational reality gap will distinguish the resilient companies from the rest. With boards committing to the sanctity of their risk oversight role, mid-sized enterprises can confidently stride forward.

Sources:

- AuditBoard Blog – “The Business Resilience Gap: A Tipping Point” (EY Global Board Risk Survey findings) auditboard.com auditboard.com.

- Risk & Insurance – “Middle-Market Businesses Face Risk Protection Gaps” (Nationwide survey of mid-market firms, 2025) riskandinsurance.com riskandinsurance.com.

- Harvard Law School Forum (Glass Lewis post) – “Corporate Governance, Board Oversight & the 2023 Banking Crisis” (Analysis of SVB, Signature, First Republic failures) corpgov.law.harvard.edu corpgov.law.harvard.edu.

- Economic Times (India) – “What’s behind the CEO resignations in India’s private sector banks?” (Governance lapses in mid-tier banks) m.economictimes.com.

- Business Today (India) – “How Zilingo’s Troubles Bring to the Fore Governance Issues at Start-ups” (Start-up governance lapses, Zilingo and BharatPe) businesstoday.in businesstoday.in.

- Reuters – “Investors of India’s GoMechanic seek audit into ‘inflated’ financials” (GoMechanic startup financial fraud admission) reuters.com reuters.com.

- ForensicRisk Alliance – “Navigating the Storm: learning from past corporate failures in the GCC” (Gulf corporate governance failures and lessons) forensicrisk.com.

- dss+ Consulting – “When Boards Miss the Warning Signs: Elevating Operational Risk Oversight” (Operational risk oversight challenges and recommendations) consultdss.com consultdss.com.

- LinkedIn Pulse – “Independent Directors: Navigating Corporate Governance” (Role of independent directors in risk oversight and culture) linkedin.com.

- BusinessToday (India) – “YES Bank independent director…resignation letter” (Yes Bank governance failure, independent director protest) businesstoday.in businesstoday.in.